The £20-a-month pact: how we planned our big group holiday seven years out

1st July 2025

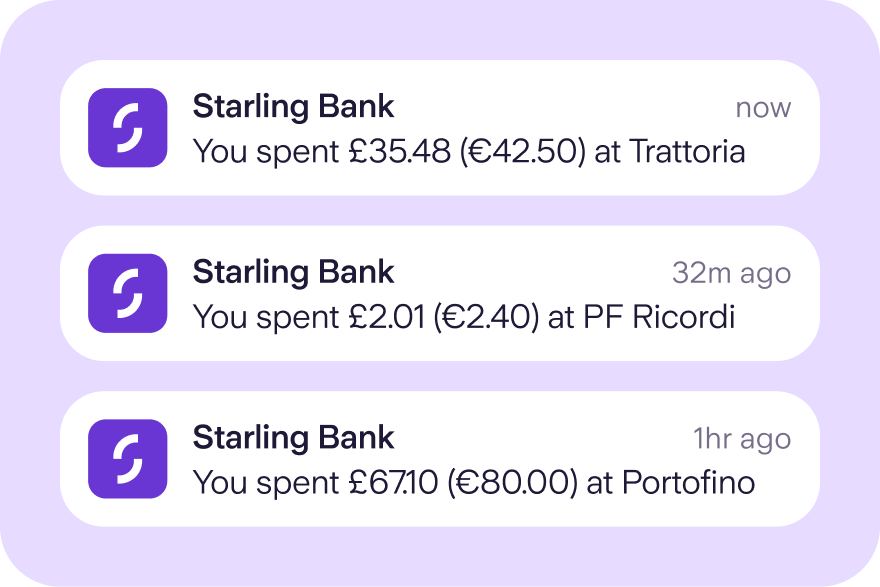

In real time, and in both currencies. So you always know what you’re spending – and stay fully in control.

Pay on card or withdraw cash abroad, with no fees from us. We’ll give you Mastercard’s real exchange rate, and won’t add anything on top.

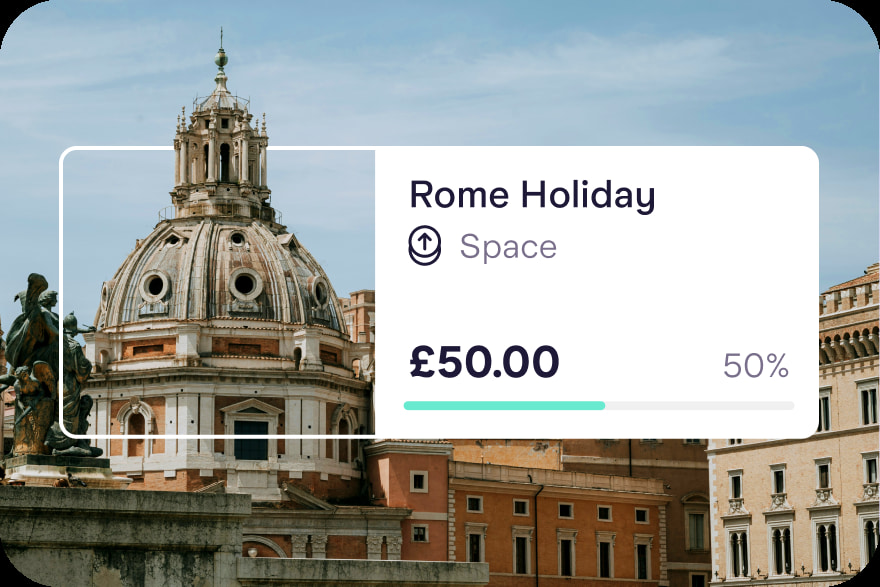

Set aside money for great escapes with Spaces, turn on Round Ups to boost your efforts, and ring fence your holiday budget by spending from a virtual card.

Benefits of travelling with Starling’s current account.

If you’re awake, so are we. Get support in-app 24/7.

Paid together? Pay friends and family - or get paid back - with Nearby Payments and Split the Bill.

Start spending from your digital wallet straight away.

Compare Starling to:

| Feature |  Starling Bank | Please select a provider above | |

| Travel | |||

| ATM EU £100 Cost | |||

| ATM World £100 Cost | |||

| Debit World £100 Cost | |||

| Debit EU £100 Cost |

Data correct as of 7 July 2025

Get more from your money with Starling’s simple, award-winning current account. With features such as instant notifications, Spending Insights and Spaces, money management has never been easier. Apply in minutes from your phone.

Need to convert GBP to USD or EUR? Use our currency converter below to calculate the exchange rate. We won’t charge you for spending overseas – but do bear in mind that some ATM providers may charge their own fee.

Already in paradise? Use our currency converter on the go. Just go to Cards in the app, then tap on ‘Going abroad?’.